The Financial Planning process involves:

1. Gathering relevant financial information

2. Setting your financial Goals

3. Examining your current financial situation & Complete Analysis

4. Coming up with a strategy or plan

5. Implement the action plan

6. Review and Update the Financial Plan periodically

Financial Planning is the process of meeting your life goals through the proper management of your finances. Life goals can include buying a house, saving for your child's higher education or planning for retirement. The Financial Planning Process consists of six steps that help you take a 'big picture' look at where you are currently. Using these six steps, you can work out where you are now, what you may need in the future and what you must do to reach your goals.

What We Can do?

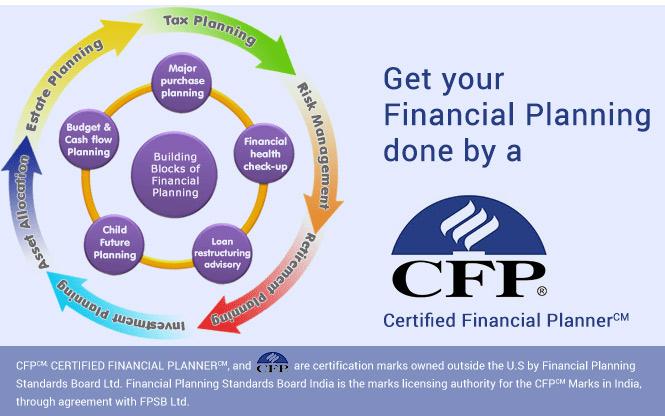

We can look at all your needs including budgeting and saving, taxes, investments, insurance and retirement planning. Or, we may work with you on a single financial issue but within the context of your overall situation. This big picture approach to your financial goals sets us apart from other Financial Advisors, who may have been trained to focus on a particular area of your financial life.

The Benefits of Financial Planning

Financial Planning provides direction and meaning to your financial decisions. It allows you to understand how each financial decision you make affects other areas of your finances. For example, buying a particular investment product might help you pay off your mortgage faster or it might delay your retirement significantly. By viewing each financial decision as part of the whole, you can consider its short and long-term effects on your life goals. You can also adapt more easily to life changes and feel more secure that your goals are on track.